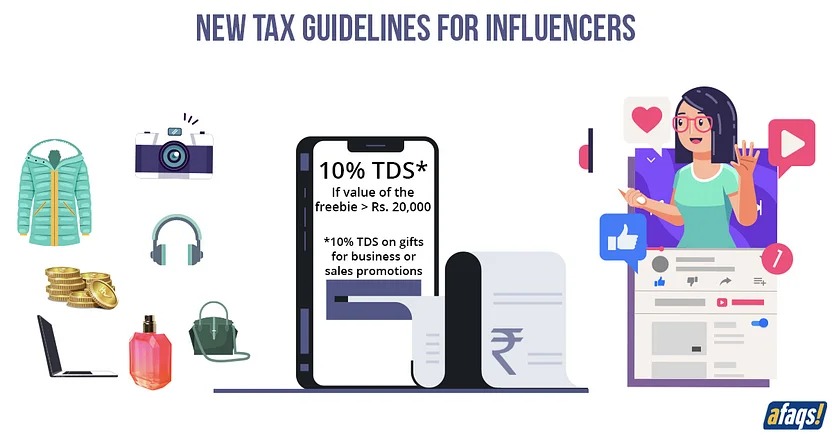

Social media influencers who accept gifts to promote brands will now be subjected to a 10% tax starting July 1. Influencers and doctors will now be required to report free samples and gifts that were given to them for marketing and sales objectives while filing their tax returns. If influencers decide to keep the products after the promotional activities are ended, TDS (Tax Deducted at Source) will have to be paid. TDS will not be required if they return the free samples.

Section 194R of the Income Tax Act requires that 10% tax, which is exclusive of surcharge and cess, be withheld at source from freebies and gifts that exceed a value of Rs. 20000 in a calendar year. This requirement has been added by the Finance Act 2022. If the brand fails to deduct the necessary TDS or if the receiver of such products fails to pay the TDS within the time frame allowed by tax legislation, an interest charge or a penalty will be levied at an appropriate rate.

The exchange of a gift or a freebie for content produced with a brand’s product is known as a barter transaction and it is one of the most popular ways that marketers work with influencers. Even though such agreements are more frequent, some brands do pay the content creators. Small firms who may not be able to allocate a significant portion of their marketing budget to pay influencers or run mainstream advertisements are more likely to engage in such barter engagements. Apparently, one of the impacts of the new rules will be experienced by small firms. The brands that happen to be on the other side of the table are affected as well. Those who give influencers extravagant gifts such as cars and high-end electronics and also sponsor vacations will feel the pinch the most.

Abhimanyu Mishra, Brand Consultant from Brandfizz states that, as per estimates, 92% of consumers prefer word of mouth referrals over other sources, and additionally, 61% expressly prefer influencer recommendations. That’s how important they have become in the marketing mix.

Sifat Khurana, who is the co-founder of Bare Anatomy, contends that small firms who are working with influencers need not be concerned as long as the gift is not more than Rs. 20,000. The ticket size increases and the transaction becomes taxable when businesses collaborate with macro influencers who charge in lakhs for collaborations.

According to Khurana, with this taking place, quality will now take precedence over quantity. The influencers will be chosen more prudently by the brands and vice versa. As per Priyanka Khimani, the founder of Khimani & Associates, if doctors receive free samples, the brand giving them can deduct the tax and share it with the hospital, which can then claim it as a wage expense. Rajni Daswani, director of digital marketing at SoCheers, says that the majority of brands these days have an influencer marketing budget set aside when it comes to their yearly spending plans. Therefore, most agreements incorporate paid collaborations.

Daswani says that the new rules may be a first step in resolving the issue when it comes to measuring the effectiveness of influencer marketing campaigns as they will give transactions a clear value. Rather than making the problem worse, it may go on to introduce new protocols which will eventually result in useful ways to determine the success as well as efficacy of influencer marketing.